S ee if you notice areas where you could be spending more or spending less.

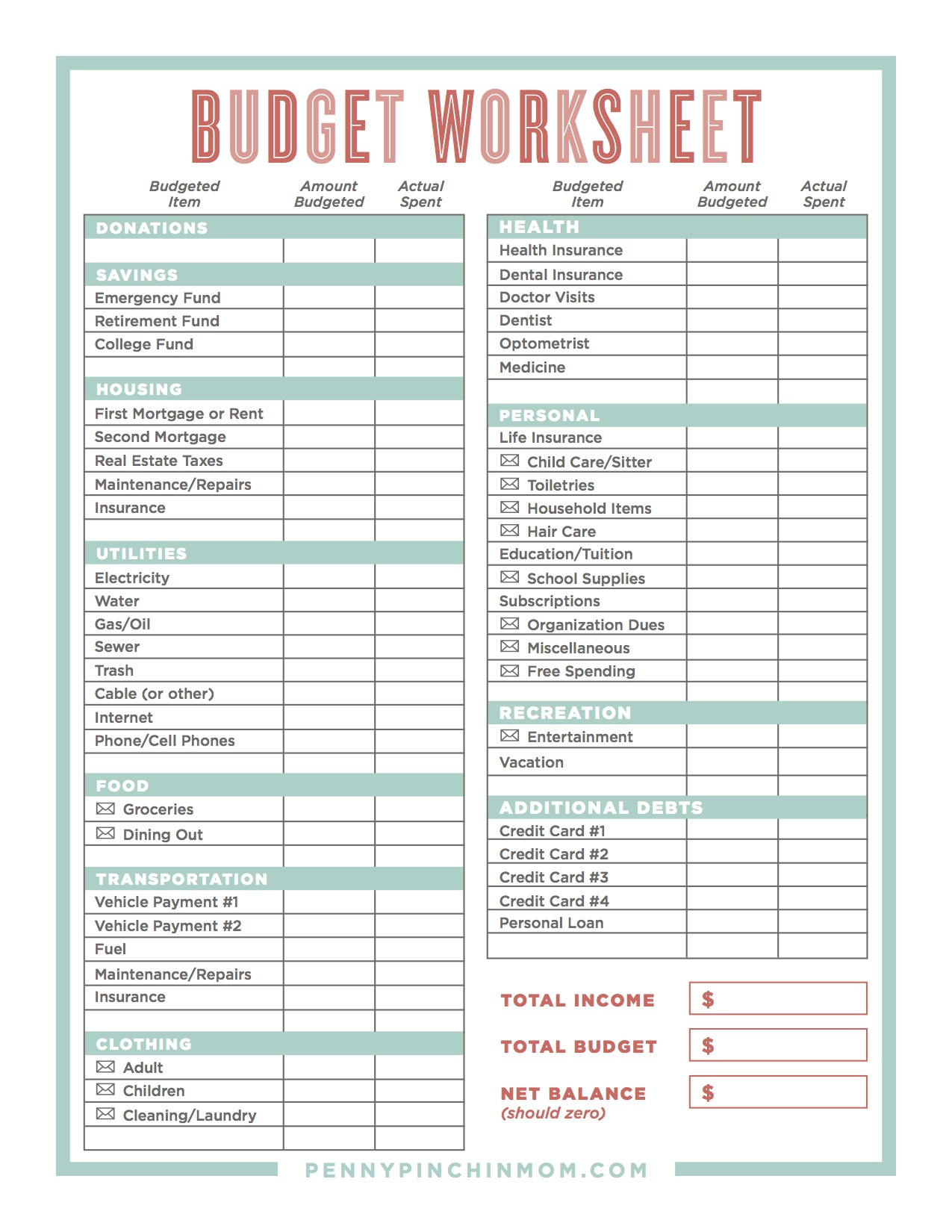

Add up the total at the bottom to ensure you’re not spending more than you’re bringing in. Then to the right, type in the amount that you spend on each one, and the date the payments are due as a reminder. Savings (Don’t forget to always pay yourself first!).Under the far left row write out your monthly expenses. To start, put together a spreadsheet document (you can use Google Sheets or Microsoft Excel). Having a good idea of how much money you actually have, spend, and can save is the first step toward true financial freedom. Instead, use your budget to accurately track and describe how your finances work. The key to creating a successful budget is not setting unrealistic goals about how much you are going to save and how much extra money you will earn. This may sound obvious, but for many people, the experience of financial stress creates a vicious cycle - you avoid thinking about money because it’s a stressful subject, which then gets you further into debt, which then causes more stress, and so on ad infinitum. The easiest way to get your finances on track is to make a detailed, realistic budget that you can stick to. If you are suffering from financial stress, keep two things in mind:ġ) You are not alone, and there are plenty of services and people out there who can help you.Ģ) There are some tried-and-tested ways to begin to feel in control of your money again. Without the right coping strategies or support, it can feel impossible to get through. In fact, research suggests that financial stress is at an all-time high in America, a phenomenon explained by the numerous hiring freezes and layoffs brought on by the pandemic.įinancial stress can be caused by a number of things: debt, unexpected expenses, or a compulsion to make purchases that we can’t afford. Not only have we had to deal with travel restrictions, lockdown orders, and fears of getting sick - many of us have also been struggling financially. The last year has been a very difficult one. Ask for help. There are plenty of services out there that can help you take back control - from financial planning services to debt management advisors to credit counseling services.

You need to name the problem to figure out the right long term solution. The financial gap resulting in your debt might be caused by a number of factors – you may not be earning enough, or you may be spending too much. Putting aside $50 a month can really add up. You should aim to have at least $1,000 in your fund until you are out of debt. Instead, aim to make it an accurate description of how your finances work. See where you could be spending more or spending less. But here’s the key: Don’t use your budget to set unrealistic goals about how much you are going to save and how much extra money you will earn. Instead, take back control by following the steps below: Read the TIAA-CREF Individual & Institutional Services, LLC, Statement of Financial Condition Opens pdf .Don’t let your finances stress you out to the point of inaction. Its California Certificate of Authority number is 6992.

TIAA-CREF Life Insurance Company is domiciled in New York, NY, with its principal place of business in New York, NY. Its California Certificate of Authority number is 3092. Teachers Insurance and Annuity Association of America is domiciled in New York, NY, with its principal place of business in New York, NY.

Each is solely responsible for its own financial condition and contractual obligations. Annuity contracts and certificates are issued by Teachers Insurance and Annuity Association of America (TIAA) and College Retirement Equities Fund (CREF), New York, NY. SIPC only protects customers' securities and cash held in brokerage accounts. TIAA-CREF Individual & Institutional Services, LLC, Member FINRA Opens in a new window and SIPC Opens in a new window , distributes securities products. Please consult your tax or legal advisor to address your specific circumstances. The TIAA group of companies does not provide legal or tax advice. Investment, insurance and annuity products are not FDIC insured, are not bank guaranteed, are not deposits, are not insured by any federal government agency, are not a condition to any banking service or activity, and may lose value.

0 kommentar(er)

0 kommentar(er)